Thanks to tech and our handy voice-activated assistants, it is more simple than ever to get the answer to just about everything. But, what if knowing all of the right answers may actually be the wrong approach? When it comes to solving any business problem, it doesn’t hurt to be educated. After all, sometimes the responsibility of taking on a new initiative like adopting a new platform with a loan software company can mean putting your reputation—and sometimes your resume—on the line.

But, how much planning is too much?

Note: The loan origination insights team at FNI always makes an effort to produce lender-focused and objective content that serves, not sells. This piece focuses heavily on our specific experiences and offerings as we believe we’ve built a tech and service-focused platform that is the smartest and most personal in the market. If you have any questions and want to learn more, please don’t hesitate to reach out to the team to start a conversation.

Deducing a Decision Strategy with a Loan Software Company

Knowing it All Can Mean Knowing too Much

The overall credit decisioning strategy is a major piece that lenders often approach us having figured out and documented. While it can be great to know who your audience is, and how certain decisions will be made, the right loan software company will be able to provide guidance and insight that may even change the way you think about how credit decisions will or should be made. For instance, with artificial intelligence being incorporated in just about everything, it is becoming easier than ever to make smarter decisions with less manual interference. In fact, our very own Blueprint LOS platform is launching an AI and machine learning-based update later this year that will change the way most of our lending partners think about decisioning, and make more educated decisions, faster.

The Tip Here: Understand your audience and general approach to decisioning, but maybe let this be an early conversation between you and your loan software company or LOS partner. Doing too much work on this up front could mean wasted time at the end.

Receiving the Right Intel

Connecting to Bureaus through a Loan Software Company

During our early conversations with lenders, it sometimes comes up that work has begun on obtaining bureau subscriber codes with some main credit bureaus such as Equifax, Experian, and Transunion. Most of the time, our lending partners find that the most efficient and effective approach is to have FNI integrate selected bureaus directly with the platform. Our existing relationships and professional history allow us to be integrated with all major bureaus in a small fraction of the time that it takes for an independent lender to complete the code acquisition and application process.

The Tip Here: After getting a conversation started, a great next step is to work with your loan software partner to acquire the necessary bureau subscriber codes. In some cases an LOS partner will walk you through or manage this process or have insight on how to best manage it.

The Right Partner Gets it Done

Understanding Third Party Integrations

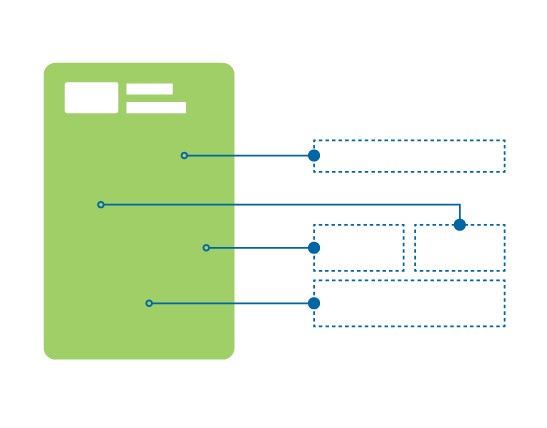

Working with a configurable LOS platform makes all the difference here. How will you communicate with borrowers? What industry-specific platforms do you need to be integrated with? If you’re an auto lender, where will you pull vehicle history reports from? Employment history?

And the list goes on.

Compiling a list and learning about all of the potential add-ons you’ll need is much better left until you’ve talked to an LOS partner. For example, for each lending vertical, FNI already has a compiled list and relationships with pretty much any platform integration you might need or even be able to think of. And, with a configurable or customizable platform, if you learn after launch that you may want to integrate something new or make adjustments, this can be a very seamless process.

The Tip Here: Instead of exhausting time and resources on searching for industry-specific platform integrations, talk to a loan software company first. They will likely have the experiences and leg-work done in developing components for—and relationships with—any brand or feature you might be able to come across. To get a peak, take a look at our ever-growing list of official platform integration partners.

It doesn’t hurt to be educated, but spending too much time ironing out every specific detail and documenting your entire process may mean time wasted, which can mean less time working on the other areas of your business that generate revenue. If you’re researching loan software companies, sometimes the best first step is to just pick up the phone or fill out a form and start the conversation there. You may be surprised how much time you save in research if you talk with the right LOS partner.

The team at FNI designs, builds, and services custom loan origination platforms, in addition to out of the box and configurable consumer lending portals. If you’re a lender, it’s likely that we have some insight that may help get you started with a speedy and efficient LOS platform.

< Back to All Resources